AI ACCOUNTS PAYABLE AUTOMATION

End-to-end automation for Accounts Payable.

Kloo delivers a wide suite of Account Payable solutions from request-to-pay that saves you valuable time and money.

Get control and visibility over spend and operational efficiency for your procure-to-pay processes. Our core modules - including automated invoice management, Purchasing Copilot, and AP Analytics - empower your finance teams to make more strategic decisions and spend less time on manual tasks.

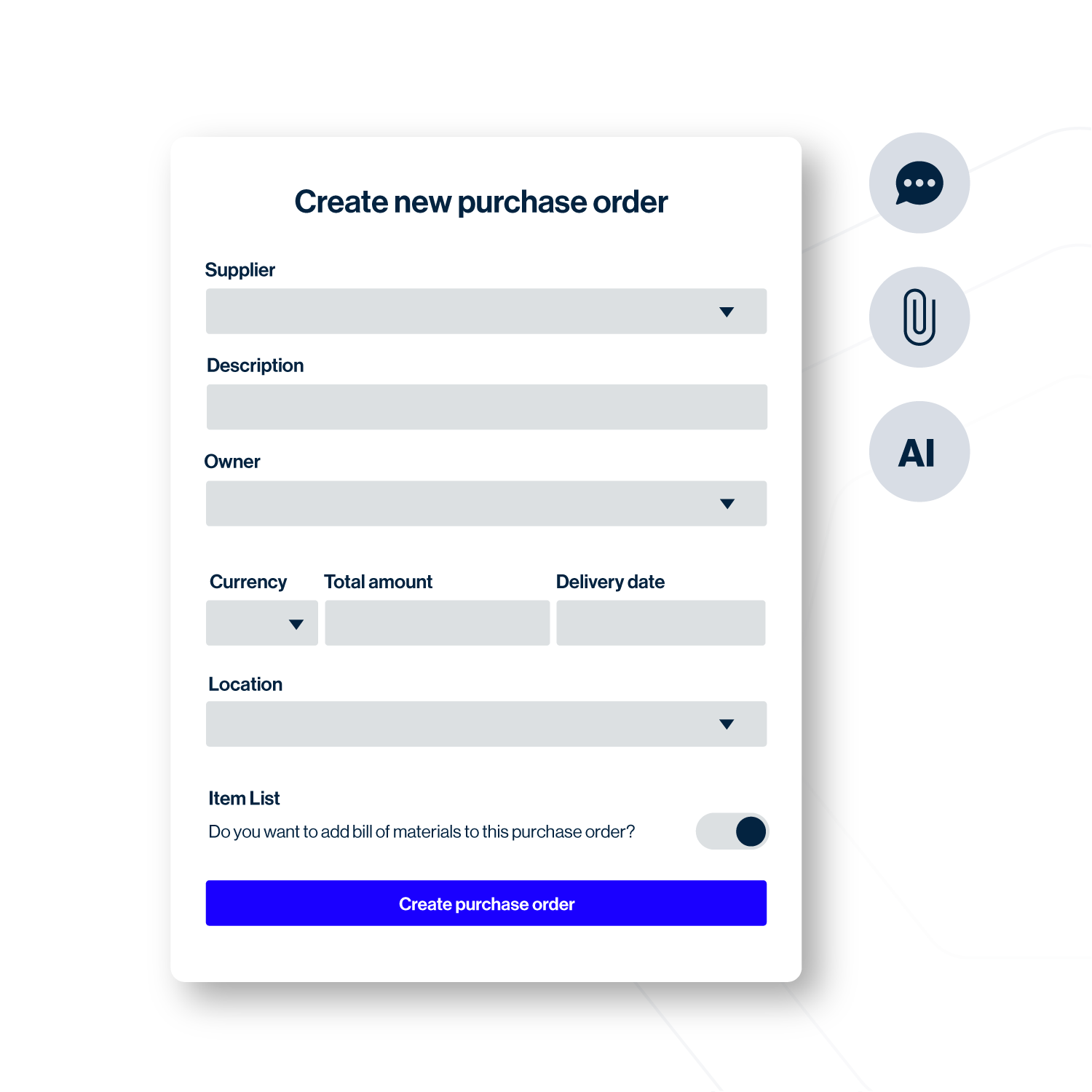

Purchasing Copilot

- Request spend in natural language via email or chatbot

- Flexible approval workflows

- Automated PO generation and 3-way matching

- Budgetary context for finance approvers

- Foreign currency PO support

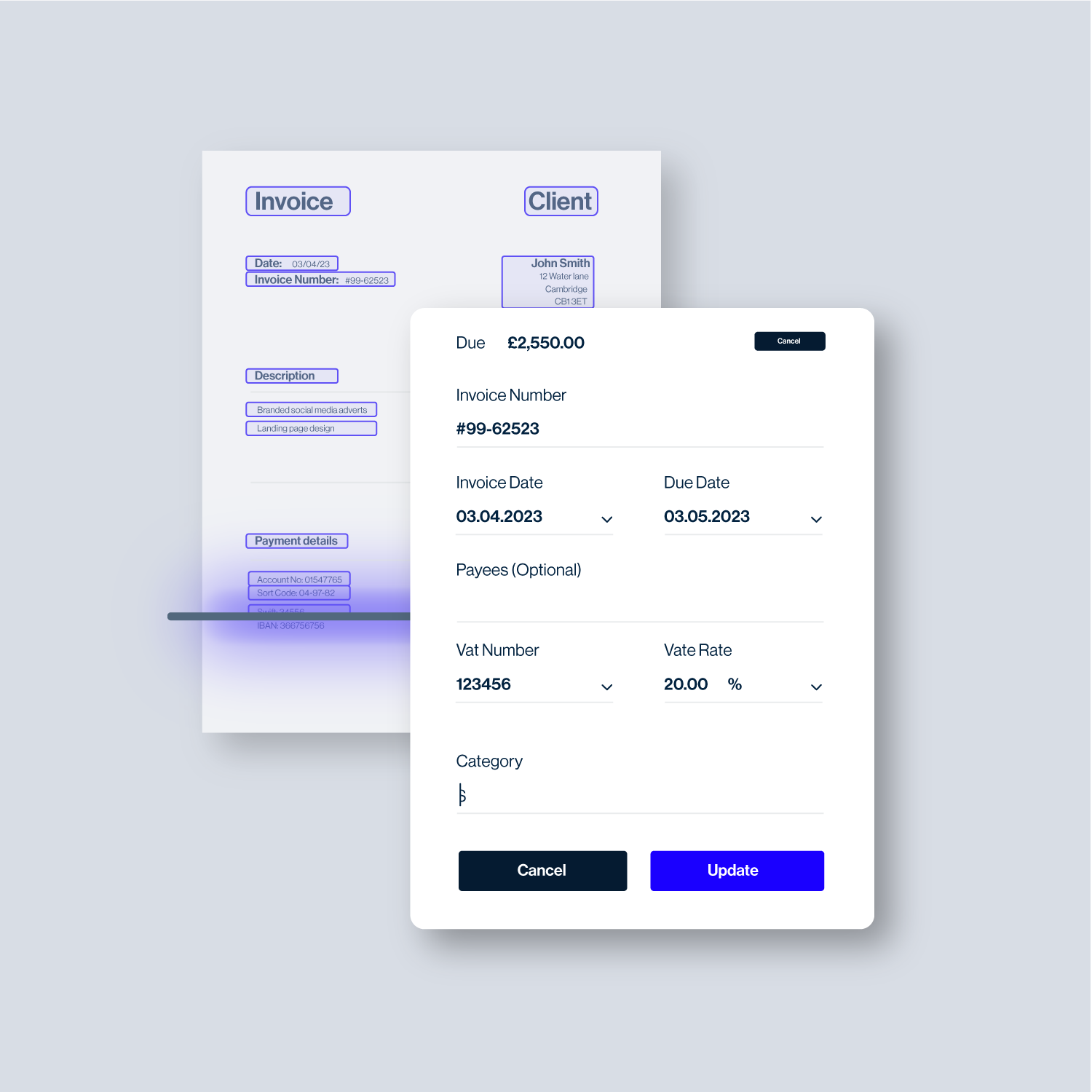

Automated Invoice Management

- Bespoke invoice inbox for off-platform invoice upload

- Advanced AI, OCR and ML-powered data extraction

- AI-powered purchase order and invoice matching

- Foreign currency invoices supported

- Off-platform email approval functionality

Spend Management

- Supplier spend analysis and cost benchmarking insights

- AI-enabled supplier negotiation templates

- Actionable supplier spend reports for cost control

- Supplier contextual details provided in email-based PO approvals

Accounts Payable Analytics

- Real-time reports and dashboards of your payables

- Query your AP data with Kloo's AI

- Focused, actionable insights

- AP scorecards to provide procurement advice

ERP Integrations

- Seamlessly transfer your data between your payment and ERP systems

- One-click uploads, no more manual intervention

- Reduce work for your team, eliminate errors and speed up the closing process

Read what our customers think...

Frequently Asked Questions

How to automate accounts payable?

To automate accounts payable, businesses can implement accounts payable software that automates processes throughout the procure-to-pay cycle, from raising purchase requests to the final payment of invoices. Accounts Payable automation software streamlines each stage using technology, ensuring accurate, efficient, and bottleneck-free AP processes with minimal manual intervention.

What is AP process automation?

AP process automation harnesses technology to automate manual tasks and streamline the accounts payable process. Using technologies including rules-based triggers, artificial intelligence (AI), optical character recognition (OCR), and natural language processing (NLP), finance teams can automate processes throughout P2P, including PO generation, invoice data extraction, matching, workflow assignment, to name a few.

The use of these technologies helps businesses scale their accounts payable and procurement effortlessly, with efficient operations and tight financial control.

Why do we need AP automation?

Accounts payable automation is crucial for scaling financial operations, maintaining tight financial control, empowering informed spending, and mitigating maverick or fraudulent spend that can damage your bottom line. By automating the accounts payable process, businesses can handle large volumes of purchase requests and invoices without sacrificing accuracy or financial oversight.

Is AP automation worth it?

AP automation is highly beneficial, with businesses using AI-powered automation reporting an 80% reduction in time spent on invoice uploads and coding. Automation transforms accounts payable from a labour-intensive and error-prone function into a streamlined and efficient process, translating into huge cost savings and ROI.

How can AI be used for accounts payable automation?

Artificial Intelligence (AI) enhances accounts payable automation by enabling systems to intelligently automate tasks using contextual reasoning and machine learning to improve over time.

In tasks such as invoice matching, AI can go beyond simple rule-based automation by adapting to recognize patterns and discrepancies, thereby increasing accuracy and efficiency as it handles repetitive tasks. This intelligent automation transforms the AP process, making it more robust and less dependent on manual intervention.

AI can also be used to improve user experience and make systems more intuitive, for example, using natural language processing to allow users to raise purchase requests in their own words.

How does AP automation work?

Accounts payable automation streamlines the AP process by using software to automate formerly manual AP tasks e.g. invoice data extraction and coding. This technology reduces manual input and error rates, improving efficiency and accuracy in financial operations. By using AP automation software, businesses can reduce wasted and maverick spend and establish tight financial control.

How to automate manual data entry in accounts payable?

To automate manual data entry in accounts payable, implement software that uses Optical Character Recognition (OCR) and Artificial Intelligence (AI) to extract and ‘understand’ the text data from documents. These technologies extract and process data from invoices, reducing the need for manual data entry and minimising errors. This approach not only speeds up the AP process but also enhances accuracy and efficiency.

What software does accounts payable use?

While most ERPs and accounting systems have some AP functionality, accounts payable is optimally managed using purpose-built AP automation software that leverages the latest technology to improve efficiency and accuracy. These systems integrate with 2-way data-sharing to your ERP, maintaining this as your single source of truth.

What is the full cycle of AP?

The full cycle of accounts payable encompasses several sequential steps that are essential for maintaining financial control. It begins with raising a purchase request, followed by the approval workflow, and then generating and sending a purchase order (PO) to the supplier. Upon receiving goods, the invoice is received, uploaded, and coded, then matched against the PO. Finally, the invoice is approved, and payment is made. This comprehensive process ensures accurate financial transactions and accountability within a business.

What are the steps for accounts payable?

The accounts payable process is a critical financial operation that involves several key steps to manage company expenditures effectively. Initially, a purchase request is raised and approved before a purchase order (PO) is generated and sent to the supplier. Upon receipt of goods, the corresponding invoice is received, uploaded, and coded. The invoice is then matched with the PO, followed by invoice approval and the final step of making the payment.

What is the P2P process in accounts payable?

The P2P (Procure-to-Pay) process in accounts payable is a cycle that starts with requisitioning goods or services and ends with payment to the supplier. It includes steps such as submitting and approving purchase requests, issuing purchase orders, receiving and verifying the goods or services, processing and matching invoices, and finally executing payments.