PURCHASING COPILOT

Power procure-to-pay with AI.

Kloo is transforming the purchase order process from an organisational burden to a strategic advantage.

Our Purchasing Copilot module simplifies the purchase requisition process, with user-centric purchase requests, smart approval workflows (that actually flow) and automated PO generation.

Get back optimised and efficient processes from procure-to-pay.

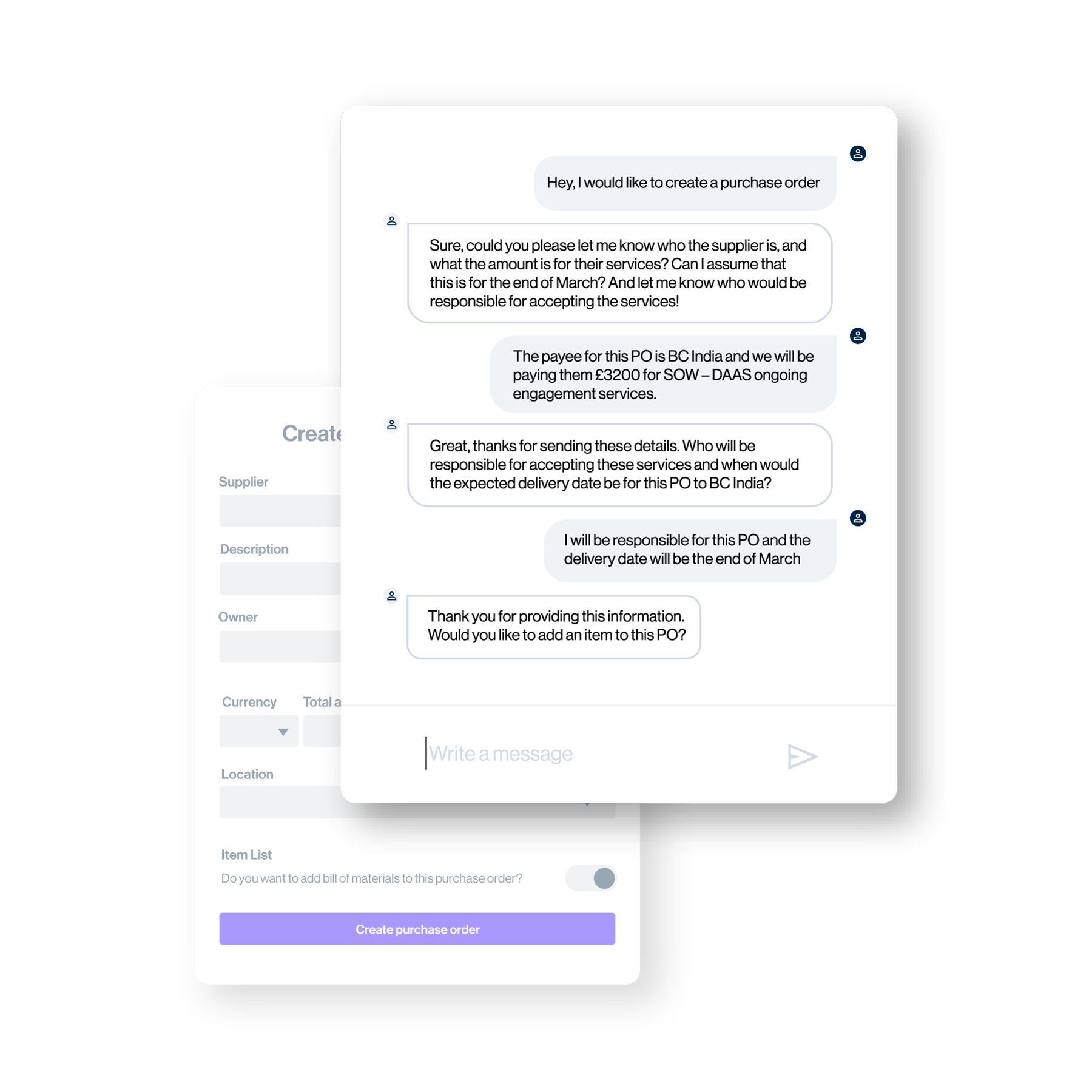

AI-powered purchase requisition

Raise purchase requests in natural language via email. Kloo's AI will ask for all the information needed to raise a request.

No more long and tedious forms: once automatically generated from your answers, you can review, amend, and submit your request, right from your email inbox.

Approval workflows (that actually flow)

Configure unlimited, auto-assigned conditional approval workflows for financial control that don't compromise on user experience.

Only the necessary approvers review each request, cutting approval times and helping approvers stay on top of spend approvals requiring their attention.

Email-integrated approvals

We understand that approvers are short on time. With Purchasing Copilot, approvers can review and approve spend directly from their email inbox, without even needing to log into the platform.

AI-generated financial context

Empower approvers with smart AI-powered insights, including how purchases will affect adherence to budgets, potential duplicate spend, and supplier context.

Approvers can make informed decisions faster than ever, without delays.

Instant PO generation

Once purchase requests have successfully passed through an approval workflow, purchase orders are automatically generated by AI. using data from the purchase request.

AI-powered automation minimises delays in the purchase order process, and therefore increases employee buy-in.

Frequently Asked Questions

What is purchase order software?

Purchase order software generates, manages, and matches purchase orders (POs). It should ideally be integrated as part of a broader Procure-to-Pay (P2P) software solution that extends from purchase requests through to the payment of invoices. This integration allows for tracking all procurement-related documents in one place, ensuring that everything is properly matched and accounted for, ensuring visibility and control over the entire procurement process.

What is the best purchase order management software for automation?

Purchase order software and P2P automation systems like Kloo can automatically raise and generate purchase orders from approved purchase requests. Once generated, the purchase order is sent to the supplier, outlining the agreement for the goods or services to be delivered. This ensures clarity and formalises the transaction, providing both parties with a clear reference of what has been agreed upon, including quantities, prices, and delivery expectations

How can I create a purchase order?

A purchase order can be created using an automated system, which generates the document automatically from a purchase request and sends it to the supplier. This method starts with purchase requests to ensure financial control, as it helps justify the expenditure, aligns it with budgets, and maintains visibility of all company expenditure.

How do I set up purchase orders for small businesses?

To set up purchase orders for small businesses, begin by implementing a system that can handle purchase requests, approvals, and generate purchase orders automatically from approved requests. This is crucial for scaling businesses, as it helps control spending while operations grow in scale. Establishing a process for requisitioning goods or services and converting these into formal purchase orders ensures that expenditures are pre-approved and aligned with company budgets.

What are the similarities between purchase orders and invoices?

Both purchase orders and invoices are fundamental documents in the procurement process, serving as official records of transactions between a buyer and a supplier.

A purchase order is issued by the buyer to authorise a purchase and detail the types and quantities of goods or services requested, along with agreed prices. An invoice, on the other hand, is sent by the supplier once the goods or services have been delivered, requesting payment and confirming the terms initially set out in the purchase order.

What are the 4 types of PO?

There are four different kinds of POs (Standard, Planned, Blanket, and Contract) which are used for different kinds of purchases.

1. Standard Purchase Order (PO): Used for one-time transactions that are not expected to recur regularly. This typically an itemised list of goods, and delivery terms.

2. Planned Purchase Order (PPO): A planned purchase order does not specify delivery dates or locations, which are decided based on need. This flexibility is suitable for items that are used periodically, such as office supplies that need restocking at irregular intervals.

3. Blanket Purchase Order (BPO): Also known as a standing order, this type covers ongoing purchases where the exact quantities and delivery timings are not predefined. This arrangement is useful for items with unpredictable usage rates, allowing orders to be made as required up to a specified maximum quantity.

4. Contract Purchase Order (CPO): This PO represents a general agreement on the terms and conditions for future orders rather than specific details about the items, quantities, or delivery dates. It sets the framework for subsequent purchase orders that are issued as needed under established contract terms.

What is the ROI of a Purchase Order System?

Considering that 51% of businesses report that spend is frequently committed before or without approval, the scope for ROI from an effective purchase requisition, approvals and PO system is significant. These systems deliver ROI in several ways:

Squashing maverick spend: This refers to unapproved expenditures that have not been requested or approved, or that fall outside of company procurement policies. By ensuring all spending is pre-approved, a purchase order system prevents financial leaks.

Increasing sourcing leverage: Fragmented spending that is not tracked centrally can weaken a company’s ability to negotiate better prices with suppliers. Central tracking through a PO system enhances negotiation power by consolidating spend data.

Admin cost savings: The automation of generating purchase orders removes the burden from finance teams who would otherwise have to manually create these documents, thus saving time and reducing administrative costs.

Who should approve purchase orders?

Purchase orders should be approved by appropriate pre-defined personnel within an organisation, using conditional approval workflows tailored to the specifics of each purchase request, such as department and purchase size.

By implementing granular conditional approval workflows, organisations can ensure that senior approvers are not overwhelmed by the volume of approvals, particularly for smaller transactions, thereby maintaining efficiency and oversight throughout the procurement process.

What does the purchase order process look like?

To read a more in-depth explanation of the purchase order process and to view an infographic, visit this blog post.