FLEXIBLE PAYMENTS

Efficient, real-time payments.

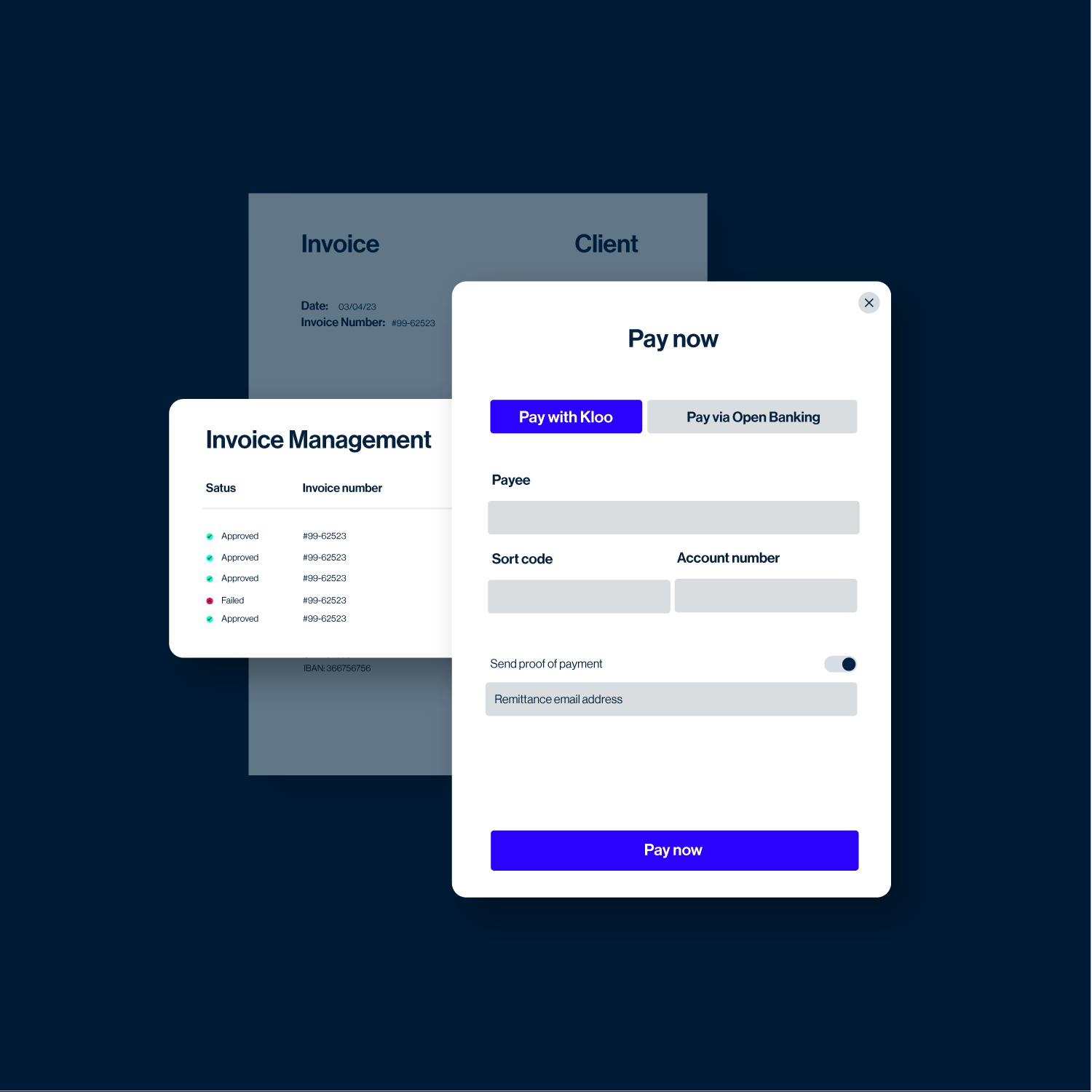

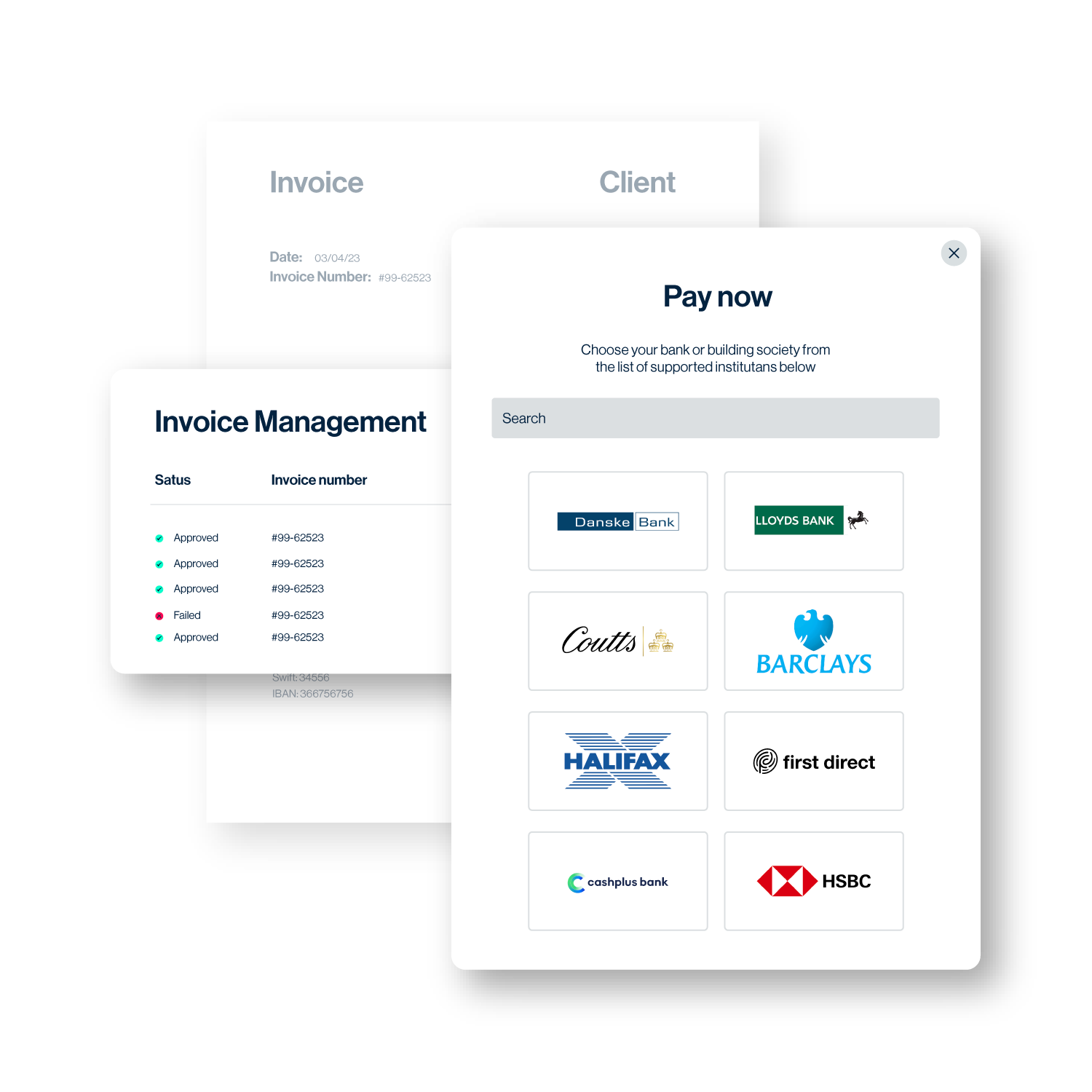

Kloo offers a range of payment options to maximise control and efficiency in payment runs.

Pay individual invoices or carry out payment runs in-platform using open banking, make payments with your Kloo balance, or pay off-platform with BACs. Whatever you choose, Kloo supports your finance team to manage payments more effectively, reduce costs, and improve cash flow management.

Experience seamless invoice payments with Kloo.

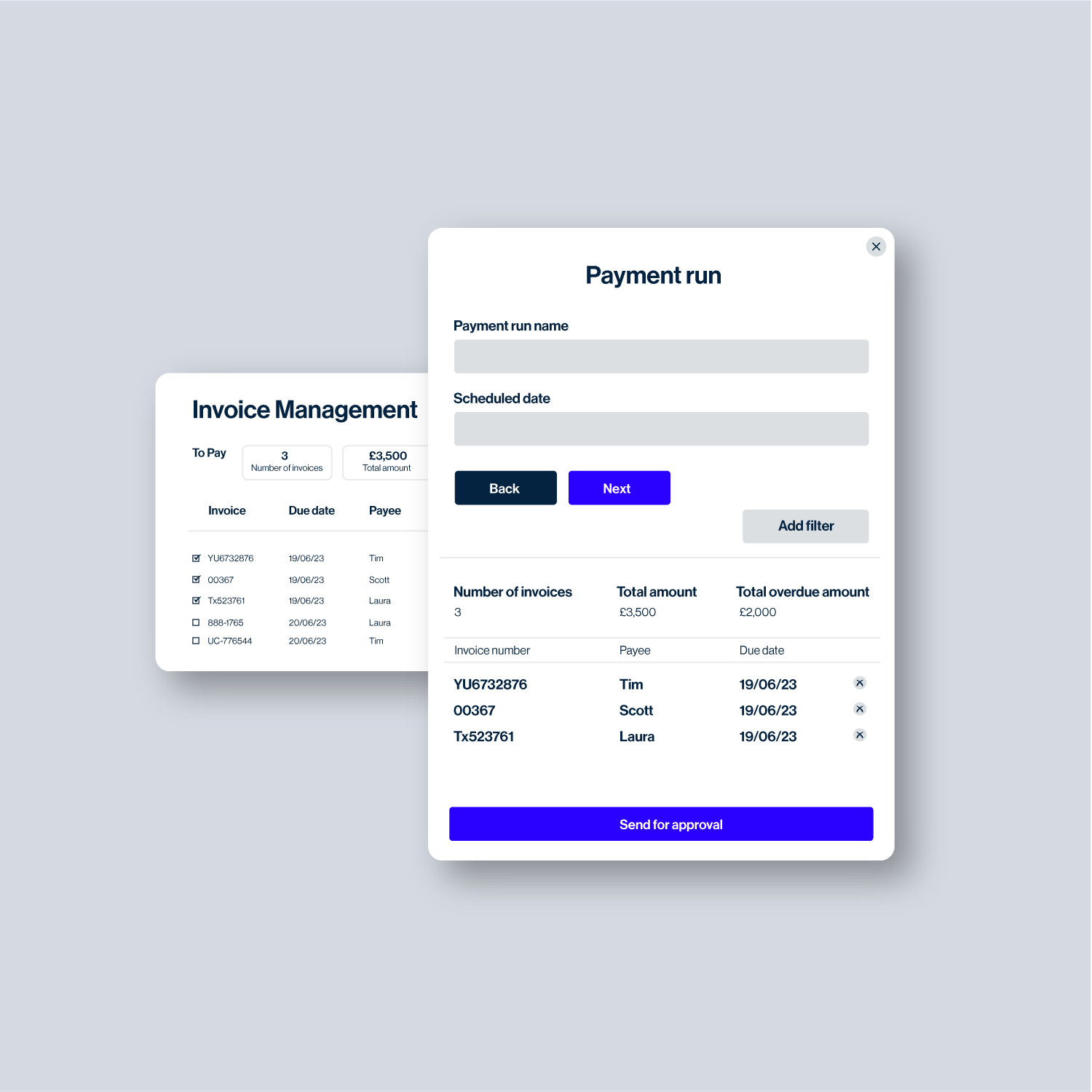

Payment run creation and approvals engine

Streamline your payment process with our automated payment run and approvals engine. Customise the payments process for your organisation with fully configurable approval workflows for invoices, which can be enabled or disabled to suit your procurement processes and policies.

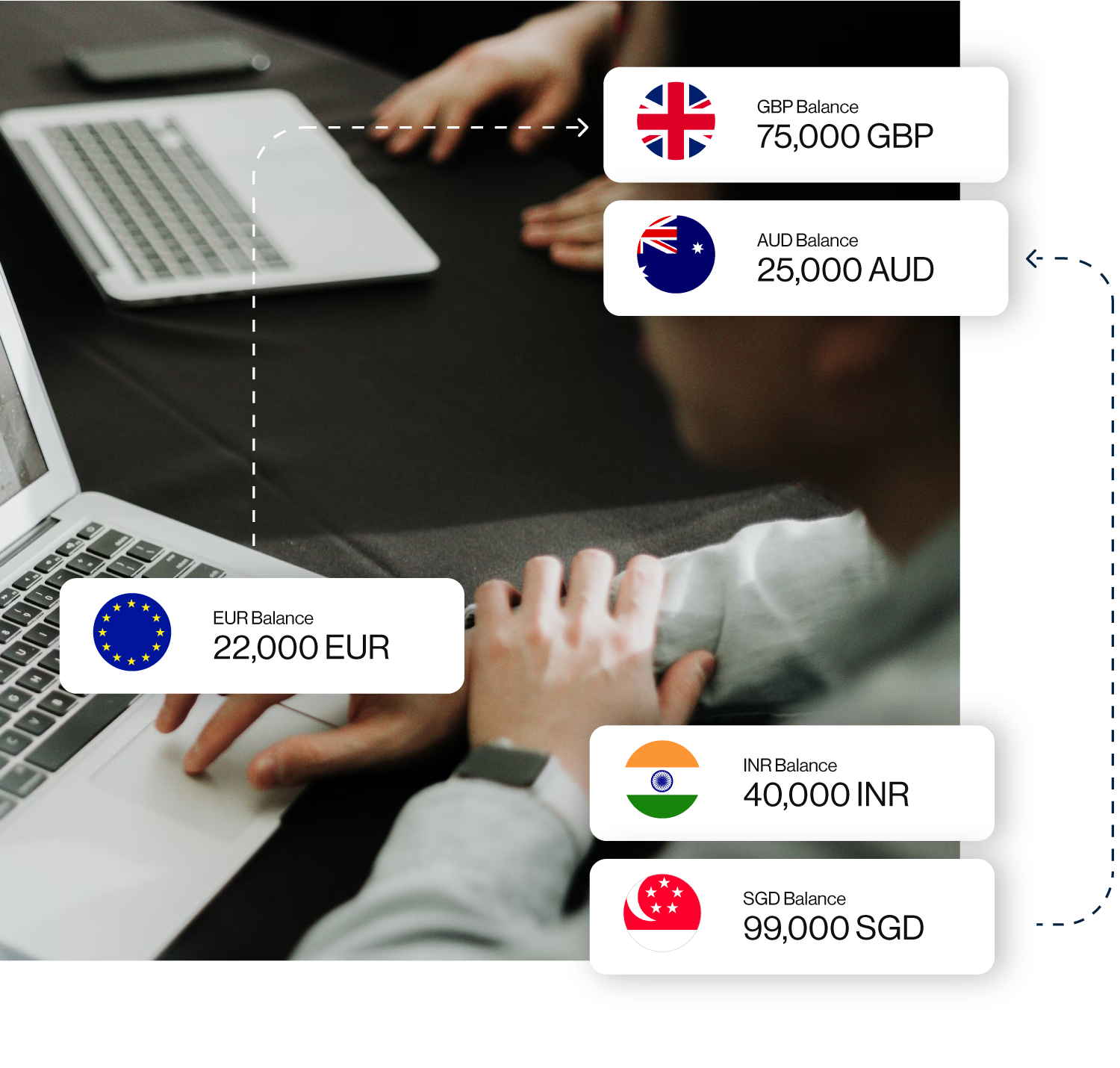

Multiple currency wallets

Kloo allows you to open a GBP and EUR wallet, simplifying storage of funds and execution of payments across currencies. This multi-wallet system enhances your ability to handle multiple currencies efficiently, making cross-border payments more convenient.

Faster and SEPA instant payments

Benefit from real time payments directly from your Kloo wallet, across the UK and Eurozone. Our platform supports both faster payments and SEPA instant payments, ensuring that your funds are transferred swiftly and securely.

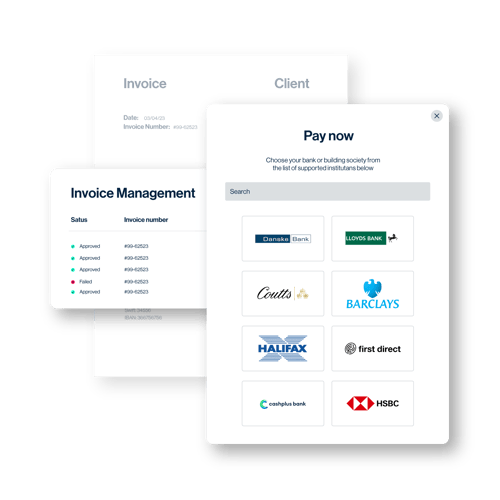

Payment initiation services

Benefit from efficiency and control of Open Banking for individual, schedules and bulk payments. Kloo enables you to release your working capital advantage by eliminating the need to have pre-funded multiple wallets.

Off-platform email approvals integration

Reduce approvals processing time with off-platform email approvals. Kloo enables designated approvers to receive and approve purchase order requests directly via email for maximum efficiency.

Actionable analytics

Kloo's real-time AP dashboards transform complex and extensive data into focused, actionable insights for your Accounts Payable. With historical and predictive reports, you gain greater visibility over your spend analytics, allowing you to monitor KPIs and drive continuous improvement.

Empower informed payment decisions.

Trusted by:

Frequently Asked Questions

How to pay an invoice?

Invoices can be paid externally through your online banking, or within your AP software, keeping your payments integrated with the rest of the P2P process. Kloo's end-to-end AP solution offers open banking so finance teams can use their banking portal to pay invoices without leaving the platform, keeping AP workflows centralised and streamlined.

How do payment runs work?

Payment runs are scheduled processes where a business executes multiple payment transactions in one go. Typically set on a regular basis (e.g., weekly or monthly), payment runs pay a group of pending invoices together to streamline payments to suppliers and manage cash flow efficiently. This method ensures timely and organised payment management, reducing the administrative burden and improving financial accuracy. With Kloo's flexible payment functionality, finance teams can either pay invoices on a one-off basis or execute payment runs of multiple invoices.

What is a flexible payment system?

A flexible payment system refers to payment arrangements that allow businesses to adjust payment schedules and payment runs based on specific needs or cash flow situations. This flexibility helps manage finances more efficiently and helps businesses optimise their working capital to match their operational needs.

What are cross-border transactions?

Cross-border payments involve transfering money across national boundaries. When paying invoices to a supplier in another country, businesses need to ensure their AP system can support diverse currencies to manage global payments.

What is a cross-border transaction charge?

A cross-border transaction charge is a fee imposed by banks or financial institutions for transactions that involve transferring money or making payments across different countries. These charges can vary based on the banks and financial institutions involved and the currencies being exchanged.

How do multiple currency wallets work?

Multiple currency wallets allow users to hold, manage, and exchange money in various currencies within a single account. This simplifies the storage and execution of payments in different currencies, providing convenience and efficiency for international transactions

What are SEPA instant payments?

SEPA instant payments are a type of payment that allows for the immediate transfer of funds between banks in the Single Euro Payments Area (SEPA). This feature enables immediate transaction processing, enhancing the speed and efficiency of payments within the SEPA framework.

Will a SEPA payment show instantly?

Yes, SEPA payments are processed instantly, providing real-time transaction capabilities, allowing for near-instantaneous financial transactions across banks within the SEPA zone

What is an open banking payment method?

Open banking allows you to use your bank as a secure window within your accounting or accounts payable system to conduct payments, eliminating the need to access your bank separately. Kloo integrates open banking for invoice payments, enabling users to stay within the Kloo platform for a streamlined and centralised payment experience.