MODERN PROCUREMENT CARDS

Spend at scale.

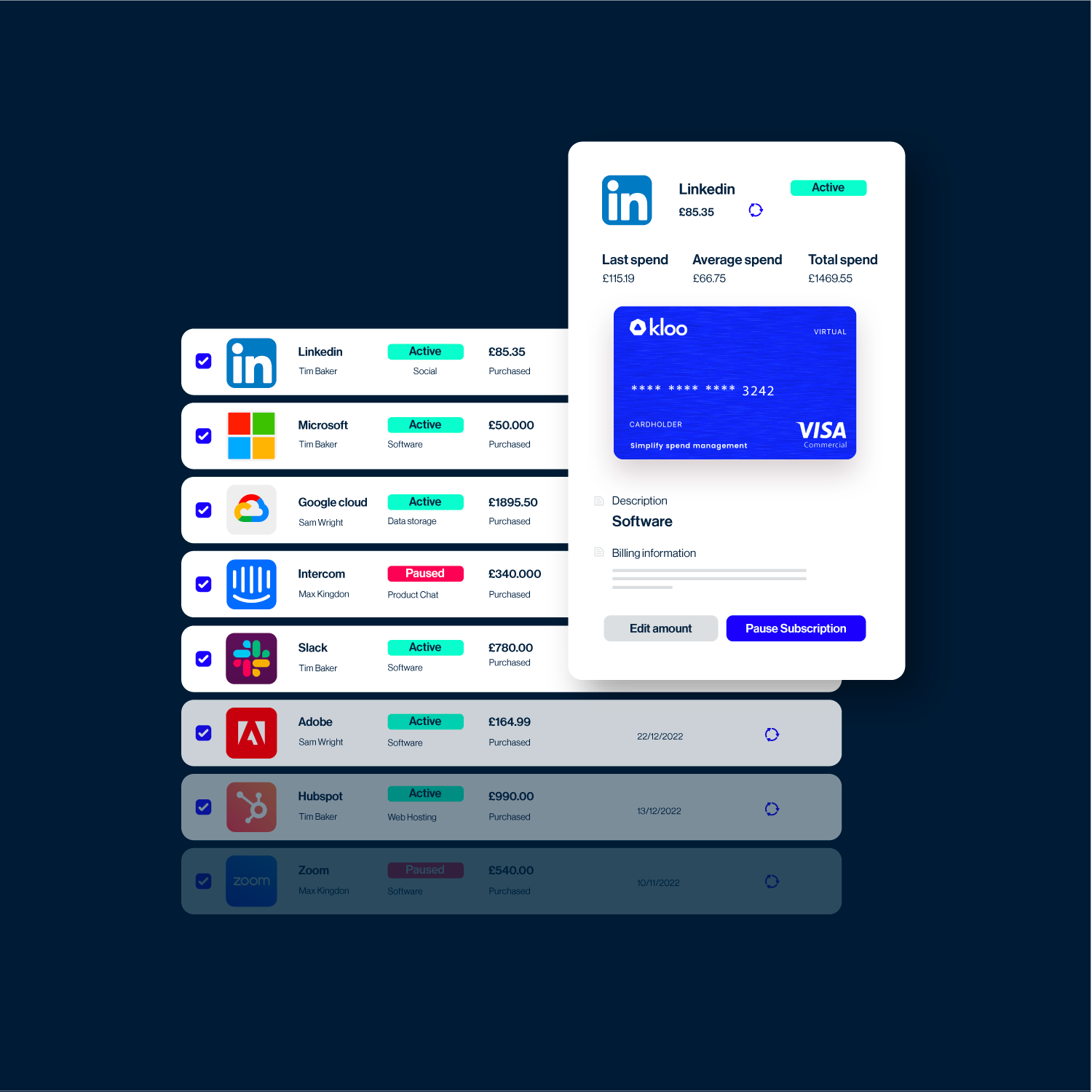

Kloo enables you to get control and real-time visibility of your corporate card spending at scale.

Issue virtual and physical Kloo cards, set spend control policies, create customisable approval workflows and automatically reconcile payments. Our intuitive platform controls empower user experience and make sure all your details are maintained in one place.

Stay on top of spend, in real-time.

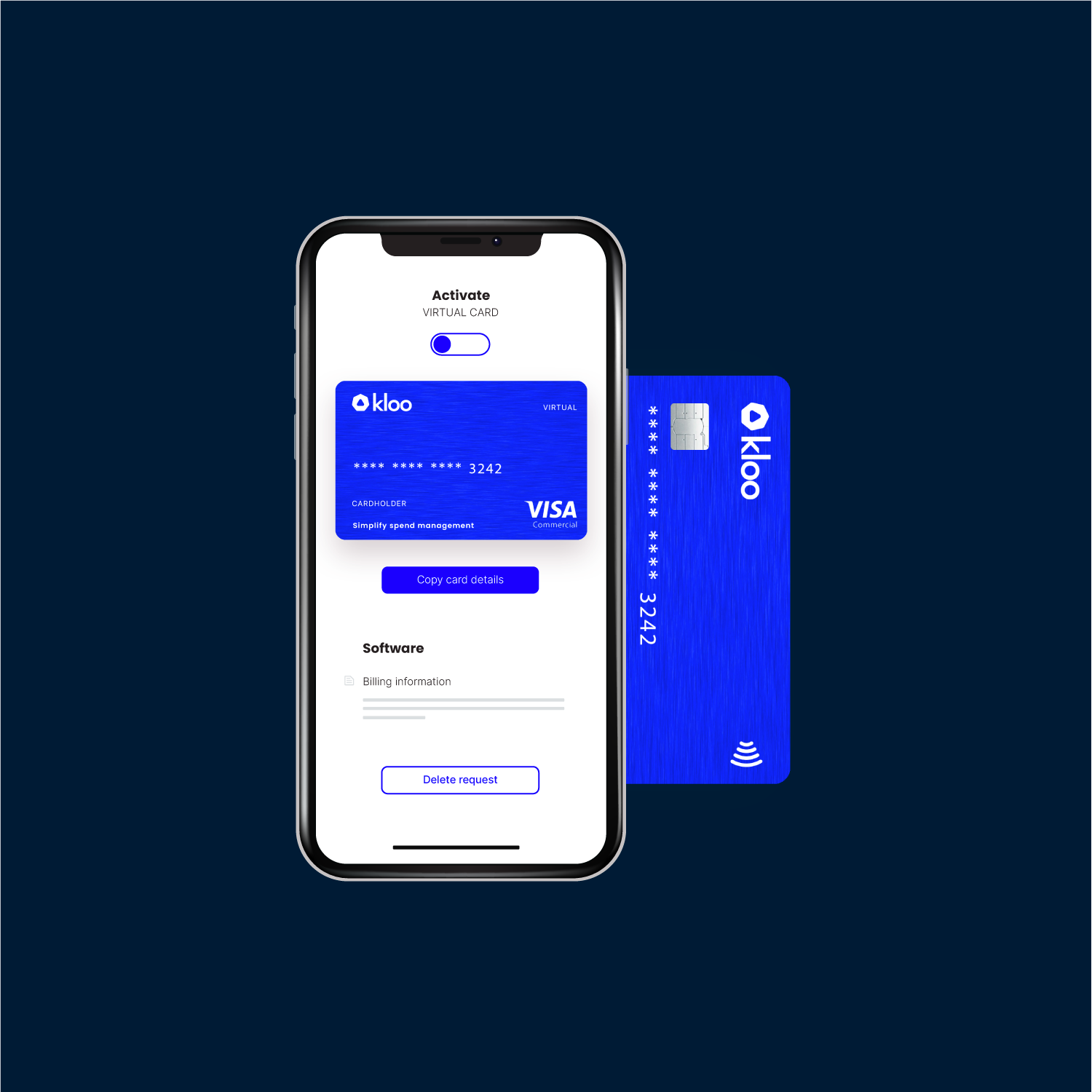

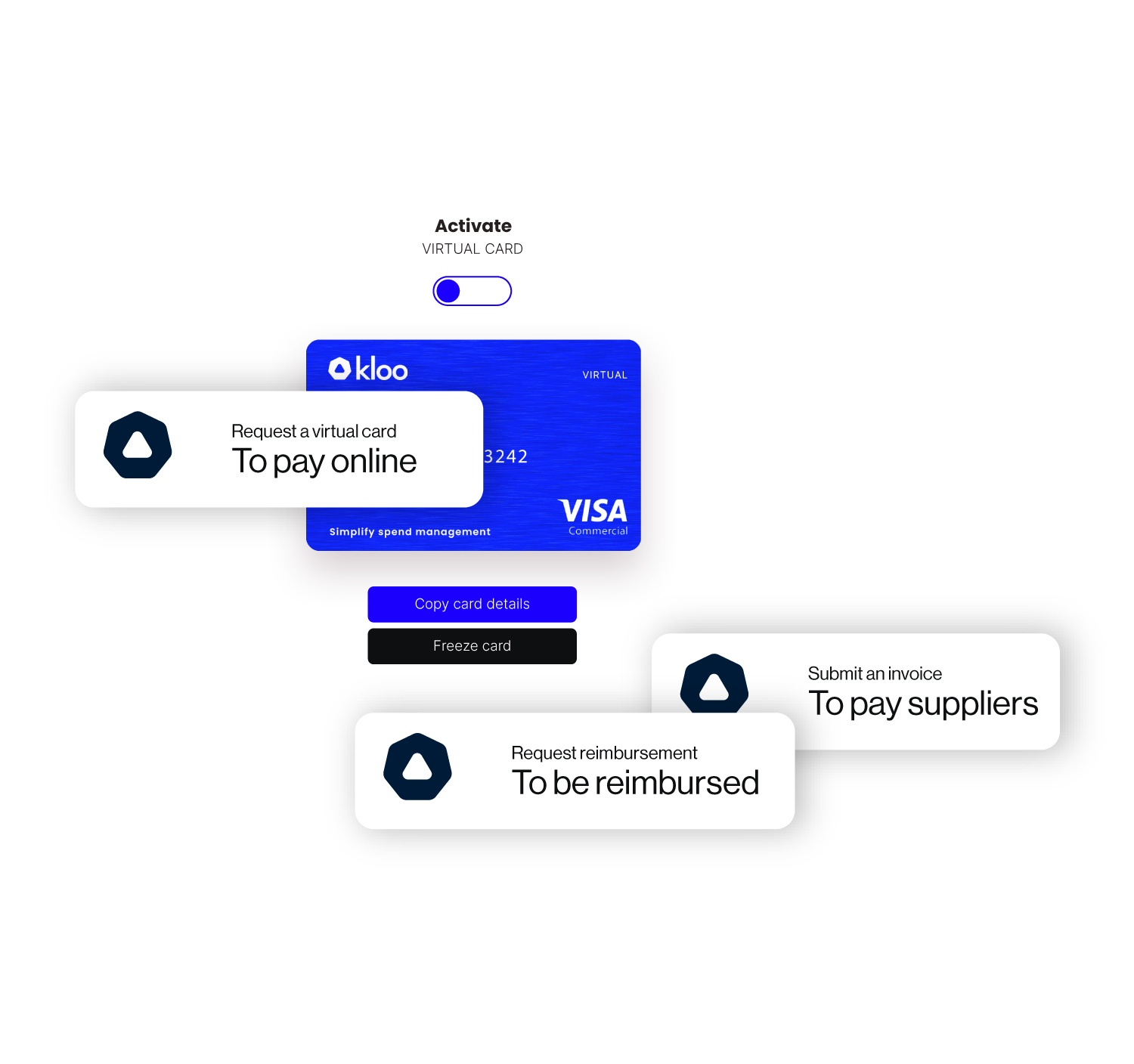

Globally accepted Visa virtual, single-use and physical procurement cards

Give your employees access to funds in a safe, controlled environment and help your finance team keep on top of business real-time spend. Track back each payment to specific users, manage spend limits and review outstanding expenses - all in one place.

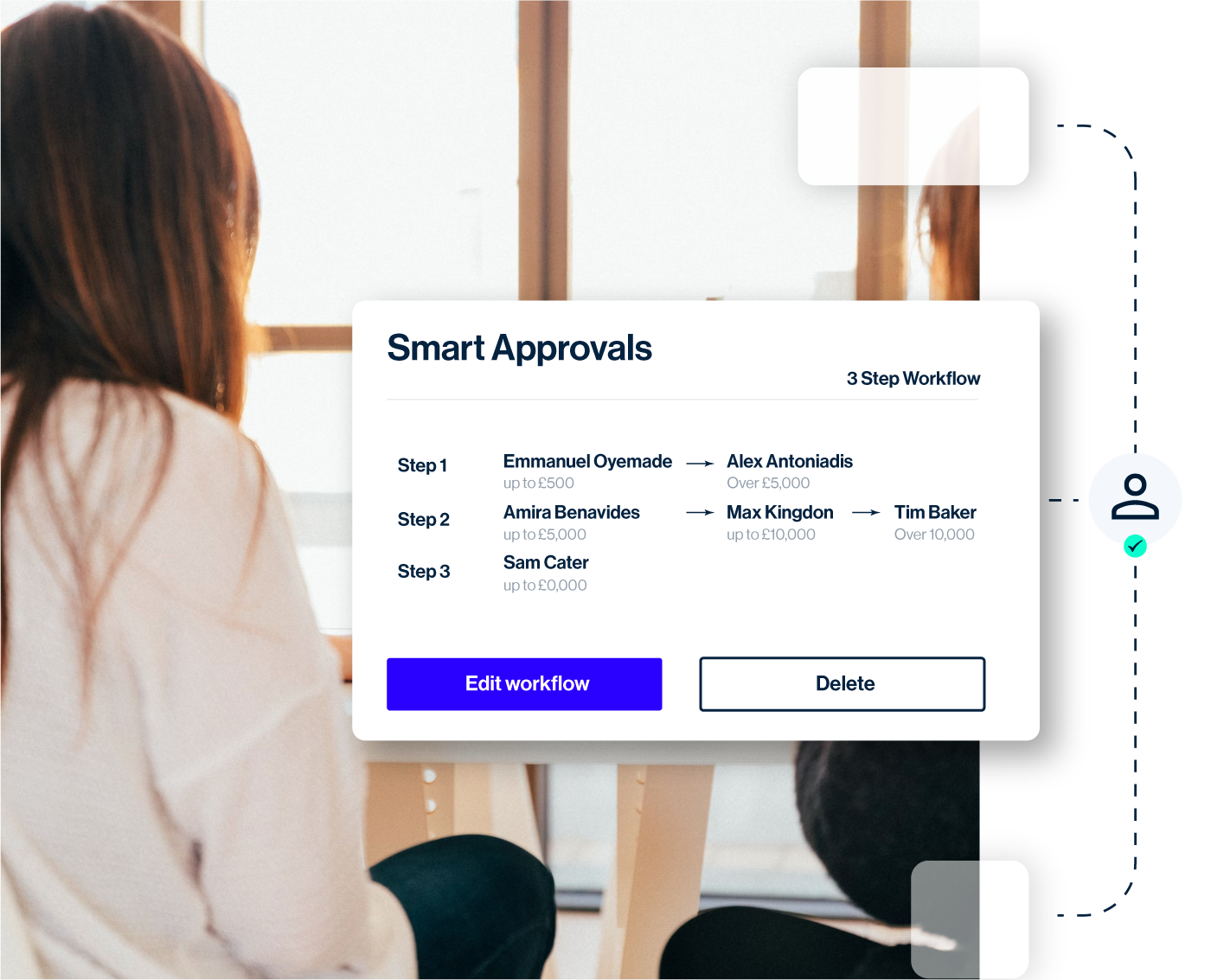

Set up agile card expense approval flows

Create custom approval workflows for individual cards or in bulk based on your definition of categories and merchant.

Update card controls directly via platform or app

Adjust individual or team card spend limits for emergency top-ups and freeze or issue new virtual cards in seconds.

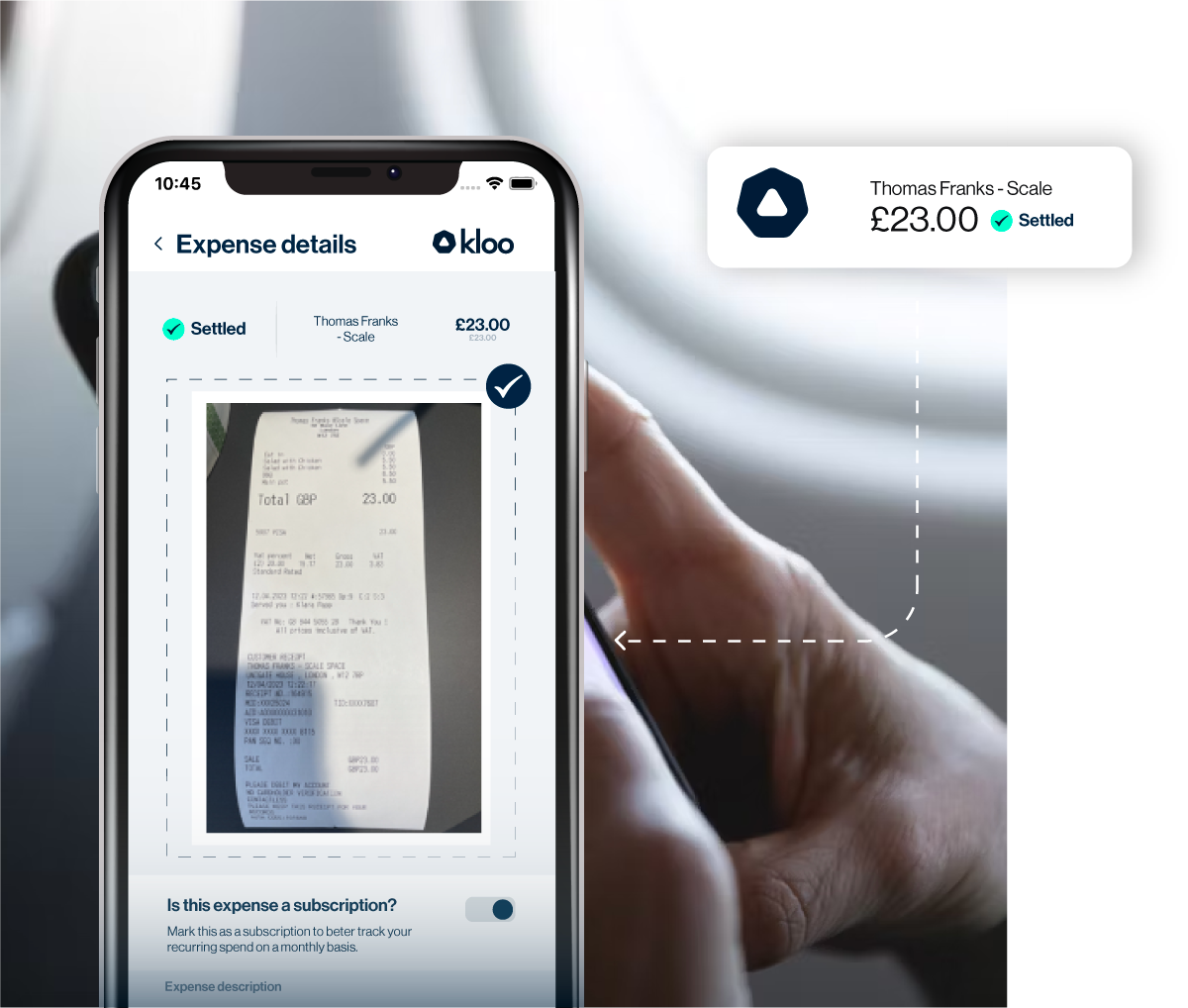

Easy & fast receipt upload

Effortlessly submit receipts via the mobile app. Kloo will read and detect the important transactional data before automating the submission for approval.

Automated receipt matching thanks to OCR data extraction

Streamline financial processing with automated receipt matching and OCR data extraction, saving time and improving accuracy.

Card spend analytics including automatic subscriptions identification

Create team cards for budgeting and for tracking your subscription spend. Control, approve and track SaaS spend all in one place and quickly see where you’re under-optimising budget with old or duplicated subscriptions running in the background.

Frequently Asked Questions

What is a procurement card?

A procurement card is a type of card used by businesses to manage purchasing and expenses. It simplifies the procurement process by allowing employees to make small, authorised purchases directly, thereby reducing paperwork and streamlining the approval process.

What is a company procurement card?

A company procurement card is a card issued by an organisation to its employees to facilitate the purchase of goods and services for business purposes. It helps control spending, provides detailed transaction records, and improves efficiency in the procurement process.

What are procurement cards used for?

Procurement cards are used for making small, purchases necessary for business operations. They help streamline the buying process, reduce administrative costs, and provide detailed spending reports for better financial management.

How are Kloo cards different to corporate cards issued by banks?

Kloo cards offer enhanced flexibility, real-time expense tracking, and integration with modern procurement systems, unlike traditional bank-issued corporate cards. They are designed to provide more control over spending and are tailored to meet the specific needs of contemporary businesses.

What is the difference between a procurement card and a credit card?

The primary difference between a procurement card and a credit card lies in their usage and billing. A procurement card is specifically used for business-related purchases and typically requires full payment each billing cycle, whereas a credit card can be used for various expenses and may carry a balance over time with interest charges.

How confident do you feel with where the company is going?

We will begin in this chapter by dealing with some general quantum mechanical ideas. Some of the statements will be quite precise, others only partially precise. It will be hard to tell you as we go along which is which, but by the time you have finished the rest of the book, you will understand in looking back which parts hold up and which parts were only explained roughly.

What is the procurement cycle?

The procurement cycle refers to the series of steps involved in acquiring goods or services, from identifying needs and selecting suppliers to placing orders and receiving goods. It includes processes such as requisitioning, ordering, receiving, and payment, ensuring that purchases are made efficiently and cost-effectively.

Let's get started

Your card is issued by Modulr FS Limited pursuant to a license by Visa Europe. Visa and the Visa brand mark are registered trademarks of Visa Europe.

For customers utilising Kloo wallets for invoice payments, whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS) your funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011.