The Alarming State of Payment Practices in the UK

The Problematic Landscape of Payment Practices in the UK

The UK Government's Payment Practices Reporting obliges all companies with over 250 employees and £35 million in turnover to make public their payment practices. This includes how long they take to pay their suppliers and what proportion of invoices are paid late. The data from the first half of 2023 paints a worrying picture of invoice management practices in the UK.

-2.png?width=1104&height=309&name=G2%20News%20(1)-2.png)

This data reveals that payment delays and operational inefficiencies are rife in the payment practices of large companies. In fact, large enterprises tend to take 30% longer than small companies to pay invoices.

Why is this a problem?

- Reputational Risk: Late payments can tarnish a company’s reputation, making it difficult to establish and maintain long-term relationships with suppliers.

- Operational Delays: Late payments can lead to the interruption of essential supplies or services, hindering operational effectiveness.

- Impact on Suppliers: According to a report by R3, 1 in 5 insolvencies can be attributed to late payments, revealing how delays in invoice payment can push suppliers to financial collapse.

Why is this happening?

It's important to understand the underlying reasons behind these alarming statistics to effectively address the issue. Here are some key factors:

- Manual Processing: This sheer volume of invoices processed by large companies translates to huge amounts of administrative time when using manual workflows. Even rules-based automated AP systems often struggle with processing and more complex invoices, forcing companies to fall back on time-consuming manual methods.

- Complex Vendor Ecosystems: Many businesses today, especially large corporations, have an intricate web of suppliers. The diversity in the types of invoices and payment terms can be overwhelming when the AP system relies heavily on manual processing.

- Human Error: In a system that relies on human input, the scope for error is considerable. From mistyped figures to misplaced invoices, human error can lead to delays and missed payments.

- Approval Inefficiencies: Often, the accounts payable process involves multiple departments and approval hierarchies, resulting in a cumbersome and slow process when not handled centrally.

- Lack of Real-Time Insights: Traditional systems may not offer real-time tracking of invoice statuses, making it difficult to address payment issues proactively.

Kloo’s Solution: AI-Powered AP Automation

AI-Powered Invoice Processing: Simple, rules-based automated AP systems often struggle with processing invoices with any degree of complexity, forcing companies to fall back on time-consuming manual methods. For instance, purchase orders and invoices may not always match 100%, perhaps one showing a company’s full name and the other an abbreviated form. AI-enabled AP software is able to automate workflows even when there is complexity involved, using optical character recognition to automatically input data from an invoice, then matching invoices to purchase orders using contextual reasoning, with a high degree of accuracy and no need for human intervention.

Automated Approvals: No more chasing down approvals. Our system automatically directs purchase requests to the appropriate, pre-defined workflow, ensuring timely and efficient processing. Automated reminders can prevent bottlenecks in the process, ensuring that each stakeholder performs their part efficiently.

Context is Key: One of the unique features Kloo brings to the table is its ability to provide supplier and historical spend context to the approval process. Approving POs is not just about looking at numbers but understanding the broader context to make informed decisions.

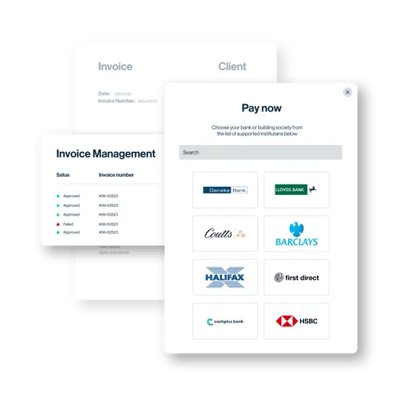

Transparent Audit Trail: Kloo’s clear, centralised documentation ensures a transparent audit trail for each transaction, from purchase order to proof of payment, all traceable in one platform. This not only enables better financial management but also empowers management to make informed decisions on the fly, affording your business the flexibility to adapt swiftly.

Integrated Payments: Make invoice payments without ever having to leave the platform, creating a single, streamlined workflow.

Processing Speed: All of this translates to far faster processing times. Invoices can be paid in a timely manner, ensuring strong, functional relationships with suppliers and operational efficiency.

In fact, Kloo allowed Oakbrook to cut time spent on accounts payable by 80%.

Takeaways

The state of invoice payments among large enterprises in the UK is a pressing concern that extends beyond just financial inefficiency; it impacts supplier relationships and can even contribute to insolvencies. Kloo's AI-powered AP automation offers a comprehensive solution, streamlining the entire invoice management process and paving the way for more responsible and efficient financial operations.

Let's get started