Streamlining Approval Workflows for Xero with Kloo

In finance operations, the efficiency of repeated processes is central to a business's success. Xero, a leading integrated cloud business software suite, provides businesses with an extensive suite of operational tools across finance, CRM, e-commerce, and more, making it a staple in offices around the globe. Despite being an impressive all-rounder, when it comes to accounts payable (AP), Xero's functionality, while sufficient, falls short of optimal operational efficiency. This is where Kloo, an advanced plugin for Xero, steps in to upgrade the approval workflows crucial for managing purchase requests and invoices effectively.

Importance of Robust Approval Workflows for Purchase Requests and Invoices

Enhanced Financial Control: Effective approval workflows ensure that each expenditure is scrutinised and validated, reducing the risk of unnecessary or unauthorised spending. This level of control is essential for maintaining the financial integrity of any business.

Compliance and Accountability: Structured approval processes help in adhering to internal and external audit requirements and procurement policy, ensuring that all transactions are compliant with prevailing regulations. This transparency boosts stakeholder confidence and ensures accountability within the team.

Efficiency and Time Management: Streamlined and automated approval workflows minimise manual intervention, speeding up AP processes and freeing up valuable time for finance teams to focus on more strategic tasks.

Xero's Current Offerings and Limitations

Xero facilitates the creation of custom approval workflows but comes with a steep learning curve, including triggers, workflow states, workflow transitions, and conditions, housed in a complex user interface. While Xero supports email approvals, the contextual information provided in these emails is typically insufficient for approvers to make an informed decision, necessitating a login to Xero for more details, which can delay decision-making.

How Kloo Fills the Gap

Kloo enhances Xero’s capabilities by offering a user-friendly and highly customisable workflow solution that addresses specific departmental needs through tailored approval chains.

- User-Friendly Interface: Kloo simplifies the configuration of approval workflows with an intuitive interface that supports the user journey, making it accessible for all team members regardless of their technical skills.

-

Advanced Customisation: With Kloo, workflows can be extensively customised, including unlimited steps which can be role-based or user-specific. Conditional routing can be set based on various parameters such as spend thresholds or custom fields like department and office location.

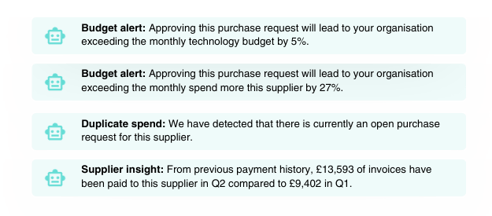

Smart Email Approvals: Kloo's sophisticated email approval feature empowers approvers with all necessary information, AI-generated insights, and historical data about the vendor directly in their inbox. This allows for informed decision-making without the need to log into the system, significantly speeding up the approval process.

-

Automated Controls: Conditional auto-approvals based on predefined criteria help streamline operations and reduce workload, allowing finance teams to focus on more critical tasks.

Benefits of Kloo's Integration with Xero

Kloo's integration with Xero provides several tangible benefits that streamline the AP process, making it a strategic asset for finance teams:

Enhanced Compliance: With Kloo, businesses can enforce compliance through customisable approval workflows that adapt to various regulatory requirements and internal policies. This adaptability ensures that all financial transactions meet necessary compliance standards, which is critical for audit readiness.

Improved User Experience: Kloo's intuitive design reduces the learning curve associated with Xero's native AP functionalities. Users can manage approvals and workflows with ease, improving overall user satisfaction and productivity.

Cost and Time Efficiency: The automation features in Kloo reduce manual tasks and streamline operations, allowing finance teams to focus on higher-value activities. This operational efficiency can lead to significant cost savings and quicker turnaround times in the financial cycle.

Integrating Kloo with Xero not only optimises approval workflows but also transforms them into a strategic component of the business, driving efficiency, compliance, and informed decision-making.

Conclusion

Integrating Kloo with Xero significantly enhances the efficiency and functionality of AP workflows. By addressing the limitations of Xero’s native features with intuitive, customisable, and intelligent solutions, Kloo empowers finance teams to manage their processes more effectively. This not only saves time but also improves compliance and financial control, making Kloo an invaluable integration tool for businesses aiming to optimise their financial operations within Xero.

To find out more about our integration with Xero, visit our website page here.

Let's get started