The Use of Purchase Orders: A Comprehensive Overview

Efficient financial management is a crucial aspect of any organisation's operations. One essential tool that aids in this process is the purchase order. Purchase orders streamline the purchasing process, enhance financial control, and facilitate effective supplier management. In this blog post, we will explore the findings of a survey published in The CFO, to better understand how companies are using purchase orders.

Understanding Purchase Order Usage:

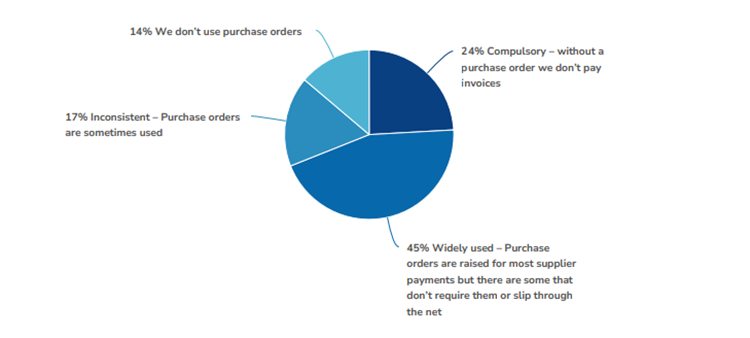

Compulsory – without a purchase order we don’t pay invoices (24%): A significant portion, 24% of respondents, reported that purchase orders are considered mandatory in their organisations. This means that without a valid purchase order, supplier invoices are not processed for payment. This approach ensures proper financial control, minimizes the risk of unauthorized spending, and fosters a structured procurement process.

Widely used – Purchase orders are raised for most supplier payments but there are some that don’t require them or slip through the net (45%): The majority, 45% of respondents, stated that purchase orders are widely used within their organisations. This indicates that most supplier payments require a purchase order to be raised. However, it also suggests that there may be instances where purchase orders are not mandatory or may occasionally be overlooked. While the organization generally adheres to the use of purchase orders, there might be exceptions for specific types of transactions or situations.

Inconsistent – Purchase orders are sometimes used (17%): Approximately 17% of those surveyed answered that purchase orders are used only inconsistently in their business. This suggests that the use of purchase orders may vary depending on the department or individual responsible for making purchases. Inconsistent usage can introduce inefficiencies and hinder financial control, as it may lead to confusion, overspending, or unauthorized transactions.

We don’t use purchase orders (14%): Lastly, 14% of respondents reported that purchase orders are not used at all within their company. This approach might stem from specific operational requirements, a less formalized procurement process, or alternative methods of financial control. However, it is worth noting that the absence of purchase orders can increase the risk of unmanaged spending, hinder accurate tracking of supplier transactions, and potentially result in budgetary discrepancies.

Conclusion: The Underutilisation of a Powerful Tool

These survey insights make it abundantly clear that purchase orders are a valuable yet underutilised tool in the landscape of financial management. While a considerable 24% of organisations make them mandatory for invoice payments, a surprising 14% don't use them at all. This absence of a systematic approach to purchase orders can lead to financial pitfalls, such as unmanaged spending and budgetary discrepancies.

This data suggests that there is still a lack of commitment to the consistent use of purchase orders. POs are not just administrative paperwork; they're a cornerstone of effective financial management and by underutilising this tool, companies are missing out on enhanced control, streamlined processes, and more robust supplier management.

So, if you're among the 31% not consistently employing purchase orders, it might be time to reconsider their role in your financial strategy.

Let's get started